Personalizing lending offers with customers’ data

Chase Bank

Shipped an MVP pilot to train an algorithm, and generated 30K+ accepted offers in 6 months

Objective

Understand consumers’ borrowing experiences, and design a trusted, data-driven lending service.

Key Activities

Collaborated with a large cross-discipline team, and ran concurrent work streams in UX, engineering, data science, and marketing.

Planned and facilitated a multi-phase research program in four US markets.

Defined borrowing mindsets, behaviors and journeys to guide product development.

Led a design team to create UX prototypes to probe discussion with interviewees and align stakeholders.

Developed a clear vision and narrative for the product’s strategic direction.

Led a delivery team to build a live MVP to fine-tune the automated underwriting technology and UX.

Outcomes

Launched the MVP feature in 10 months, which saw a 97% approval rate and almost 200 acceptances in ~3 weeks.

In 6 months, the initiative resulted in 26K accepted credit card offers, 4.3K accepted car loans, and 567 accepted home lending offers.

The generative research was the foundation for the redesign of the Buy a Home experience, and 2019 marketing initiatives.

Multiple teams used the design artifacts for a best-in-class process, feature ideation sessions, and cross-product opportunity discovery.

Minimized delivery timelines by running UX UX work streams concurrently with the data pipelining and modeling.

We shipped an end-to-end MVP experience that would give us enough data to train the automated underwriting algorithm for credit cards, and personal, auto, mortgage and refinance loans.

We were innovating on top of a legacy technology stack and design system, so I stayed closely connected to the core UX team so that we could understand and design for platform constraints, and leverage upcoming additions and changes.

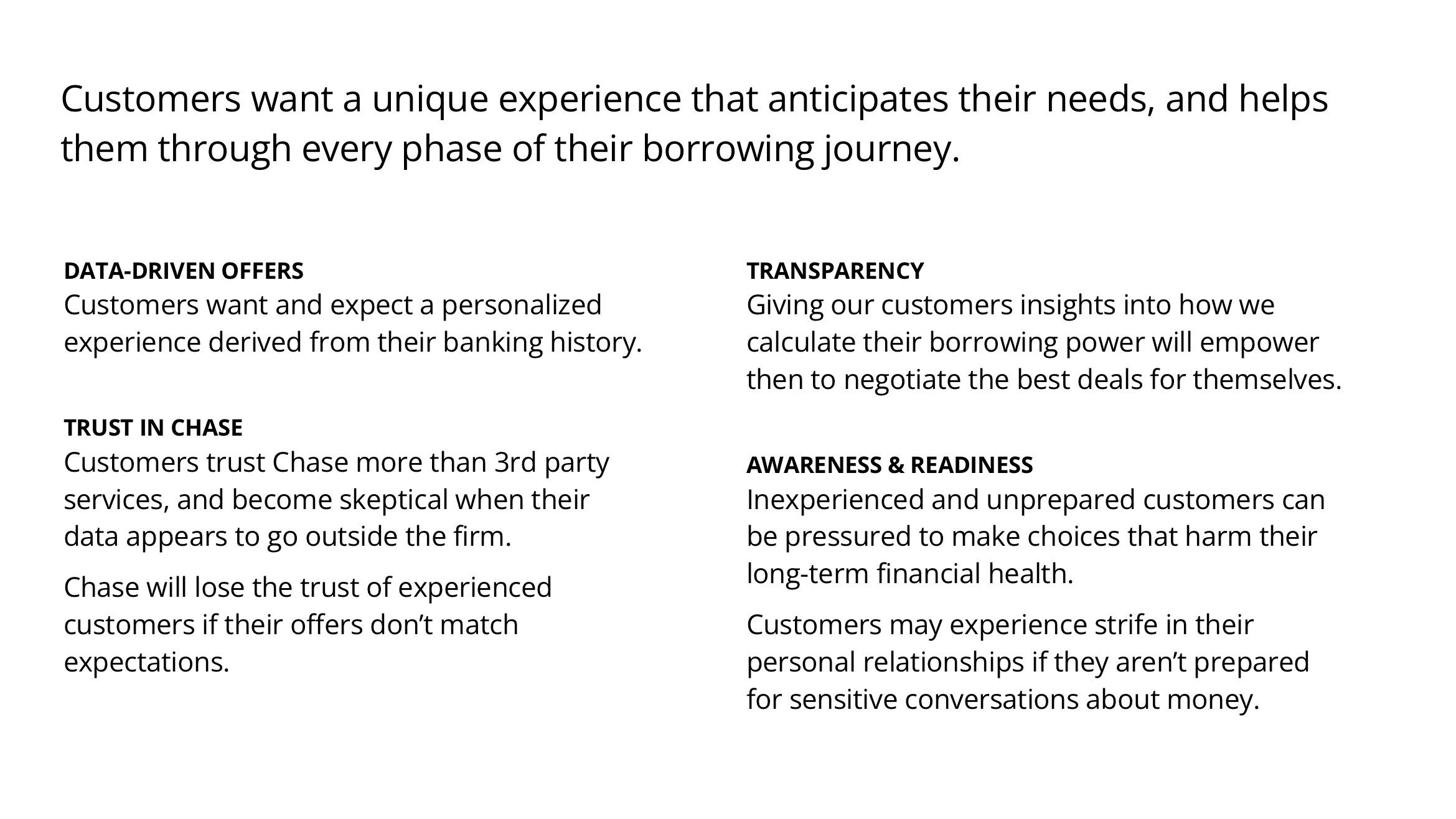

Key Insights & Customer Needs

We found four major themes around consumers’ sentiments towards borrowing. Most customers expected Chase to use their data to tailor loan offers that fit their financial needs. These high-level insights confirmed our hypothesis around data-driven offers, and helped drive feature development, and content strategy.

These design principles were used throughout the Chase product team to ensure a consistent understanding of key terms and concepts, and to guide design and content decisions for the data-driven offers experience across the Chase ecosystem.

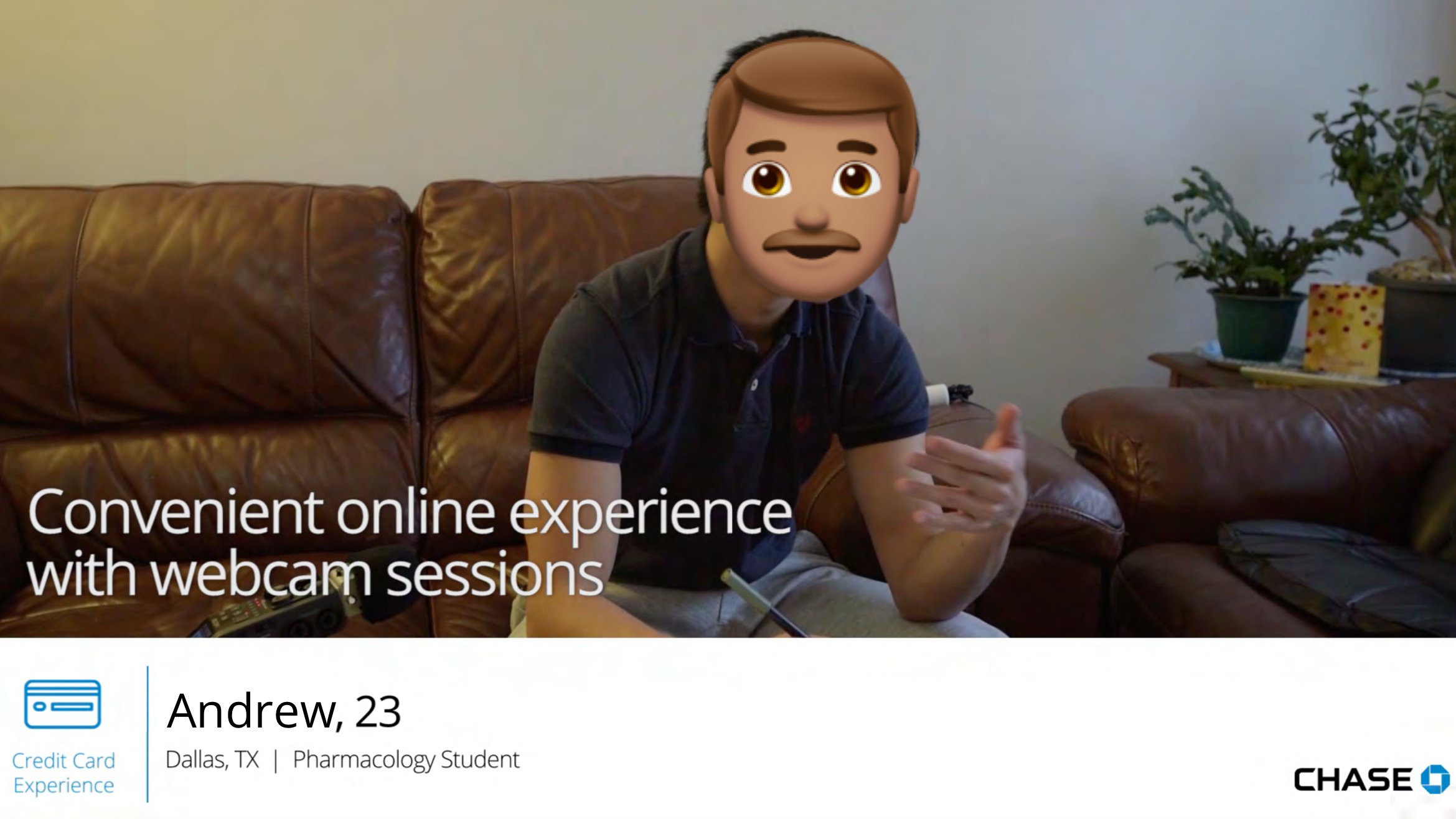

Working with our video team, we produced a research highlight reel that was shared across the firm to build customer empathy around borrowing expectations and needs.

Planning the Research

The team followed a multi-phase Double Diamond process to ensure we were “building the right thing, and building the thing right”.

We utilized field research, landscape analysis, team workshops, UX artifacts, iterative design, and agile sprints to ship an MVP that trained the underwriting system and gathered valuable feedback for future design sprints.

Involving the entire team in research and strategy early and often built customer empathy, and leveraged team knowledge and strengths.

Chase has multiple lines of business that offer loans and credit to consumers, and we wanted to understand the diverse needs and experiences across lending products. We recruited loan-eligible customers across a range of demographics, tech use and borrowing experiences, as we wanted to tightly scope our focus to loan acceptance criteria.

Research Artifacts

To prime in-person interviews, I had our participants complete a collage workbook to document their borrowing experiences that we reviewed during the sessions together. I provided relevant images, words and journey templates to prompt collage building. These materials gave us a consistent framework for later analysis.

Building and sending collage workbooks takes time!

We used comparative scale sheets to track participants’ responses during the interviews. In this example from an interview with a married couple, we could easily see and recall their differing attitudes and behaviors around banking and borrowing.

Defining the Experience

I synthesized field research and existing marketing profiles, and defined five customer archetypes based on life stage, financial health, risk profile and portfolio maturity.

Archetypes are aspirational, and customers will move from one to another over time, and as they grow financially. For instance, someone who is an adventurer will eventually grow into an established customer as they grow their wealth and credit through experience and time.

I created journey maps for each archetype to document their actions, thoughts, and feelings across different borrowing experiences. We chose experience themes for each archetype to reflect their greatest challenges - for example, Nesters are generally first-time home buyers and need more support and guidance than an Established archetype. These high-level maps helped team members easily compare and contrast customer journeys, as well as focus on one archetype to build a specific user flow and guide further explorations.

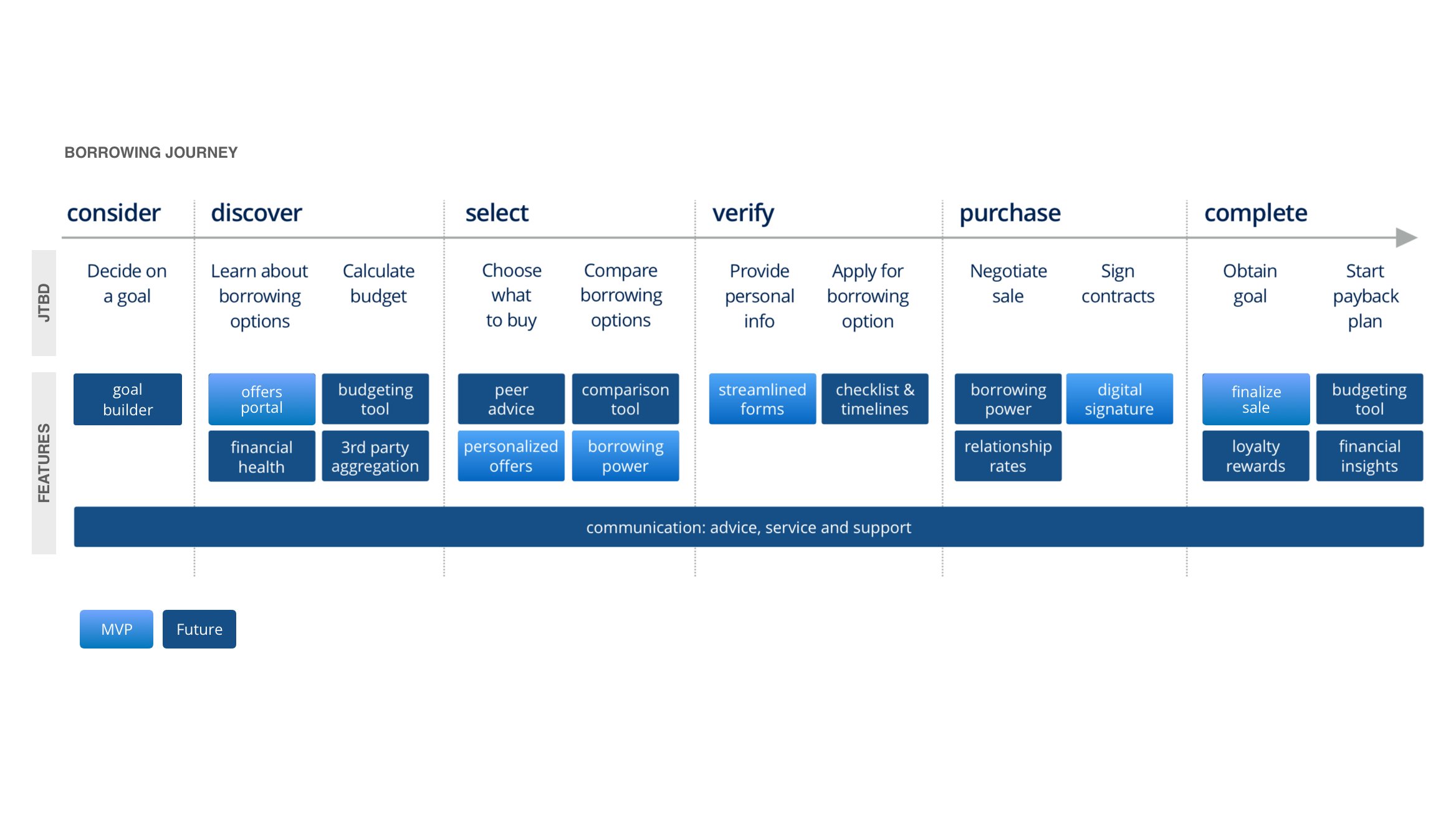

Prioritizing the MVP

I collaborated closely with product and engineering to prioritize the minimal viable product features needed to gather data through an end-to-end product experience.

We deprioritized features that other teams were exploring, such as a goal builder and a budgeting tool, knowing that those features would come at a later date to augment customers’ decision-making process.