Proactively protecting and educating banking customers builds trust and loyalty.

Chase Bank

Ran a live pilot to prove out cutting-edge technology, saving the bank $$$ in prospective costs

Objective

Understand consumers’ attitudes and behaviors around sharing data, and develop products to educate and protect them as their digital lifestyles expand.

Key Activities

Collaborated with a small, stealth team of c-suite, engineering, product and marketing.

Planned and facilitated a multi-phase qualitative and quantitative research program in four US markets.

Identified trends and opportunities through competitive and market research.

Defined the primary audience, privacy mindsets, behaviors and journeys to guide product development.

Created UX prototypes to probe discussion around real world risks.

Developed a clear vision and narrative for the product’s strategic direction and presented to C-suite executives.

Led a delivery team to build and run a live-data pilot with 100 internal participants.

Outcomes

Saved Chase Bank tens of millions of dollars in prospective costs by pressure testing a privacy and security internal pilot that showed challenges with the bank’s legacy platforms.

Select privacy and security tools were shipped on JPMC’s UK modern digital banking platform.

Privacy and security mindsets, customer journeys and content strategy educated data-driven feature teams, like Chase’s Security Center, and drove trust-building user experiences.

A patent for AI-managed privacy policies was awarded in July 2024.

Chase’s privacy and security experience comprises of multiple touchpoints across channels. Customers can check account security, request their data, and be educated about Chase security measures along their banking journey.

We envisioned next-gen privacy and security tools to proactively protect customers as they live their digital lives.

Findings & Insights

As we connected consumers’ sentiments to business and behavioral risk, we noted potential impacts to customer growth and engagement across the bank’s ecosystem. These insights were crucial as data-driven features were being planned and implemented across multiple lines of business at Chase.

I created visual graphics and frameworks to help educate teams about data privacy basics. Teams across the organization used these tools to reframe their projects through the data privacy and security lenses.

Planning the Program

I developed a multi-phase research program to connect with customers at key moments along the project lifecycle, and support team learning and decision-making.

We utilized field interviews, Kano feature analysis, in-lab usability studies, an adaptive conjoint quantitative study, and a live data pilot to learn first-hand about consumers’ levels of data privacy literacy, trust in Chase, and preferences for privacy and security tools.

Chase has a diverse customer base, and we had several hypotheses for primary audiences and the features that would educate and protect them. We recruited across a range of finances, demographics, tech use and data privacy literacy to build a robust understanding.

Key members from design, product, and engineering ran interviews with customers together, expediting team learning in this highly technical subject area. We built customer empathy early, enabling everyone to advocate for varying customers’ needs, and knowledgeably brainstorm, ideate, and make collective decisions.

Defining the Experience

I synthesized field and secondary research, and defined five customer mindsets based on data privacy literacy, technology usage and reliance, and willingness to share data.

We found that throughout our interviews, the very act of discussion raised awareness about nuanced data privacy risks, and highlighted the need for education to ensure a foundation of data privacy literacy.

We ran an adaptive conjoint study, integrating a privacy segmenting tool, which helped the team decide on the primary audience, the Carefree Cavalier, and their preferred feature bundles and price points.

These design principles were used throughout the Chase design team to ensure a consistent understanding of key terms and concepts, and to guide design and content decisions for the privacy and security experience across the Chase ecosystem.

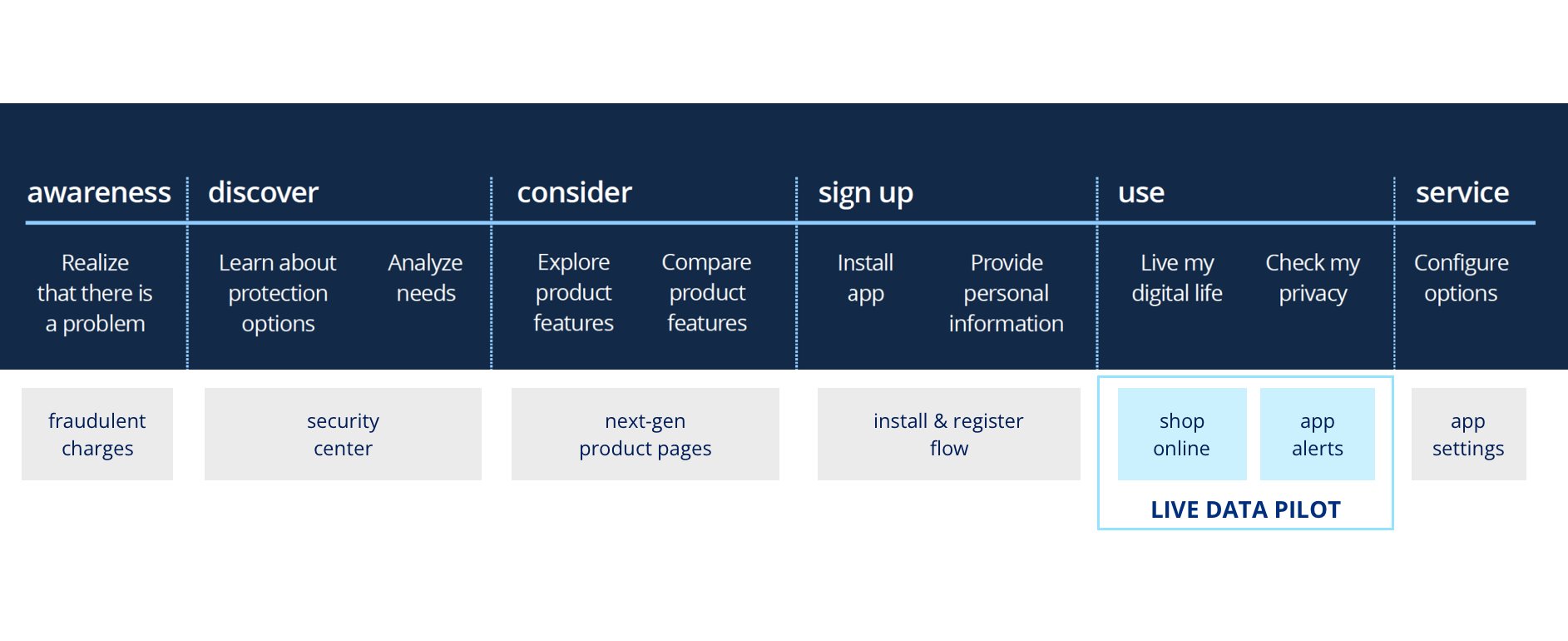

We prioritized building out features in the Use phase of the end-to-end journey for the live pilot to prove out the protection technologies, a mission-critical task. Over three weeks, we quickly learned that although the technologies worked, they hampered the mobile app performance. Leadership decided to move the project to JPMC’s digital bank in London, saving the firm tens of millions in prospective costs.